內容目錄

緣起:

2021/11/14 補注: 請注意本篇在撰寫當時的假設是用MTUM的”現有持股”去做回測, 但MTUM每半年都會換股, 建議到黑石的網站找每月的持股來回測, 結果會大不同.

https://www.blackrock.com/americas-offshore/en/products/251614/ishares-msci-usa-momentum-factor-etf

這週阿批心血來潮, 想到一個美股相關的投資策略點子, 融合兩個絕讚的因子:

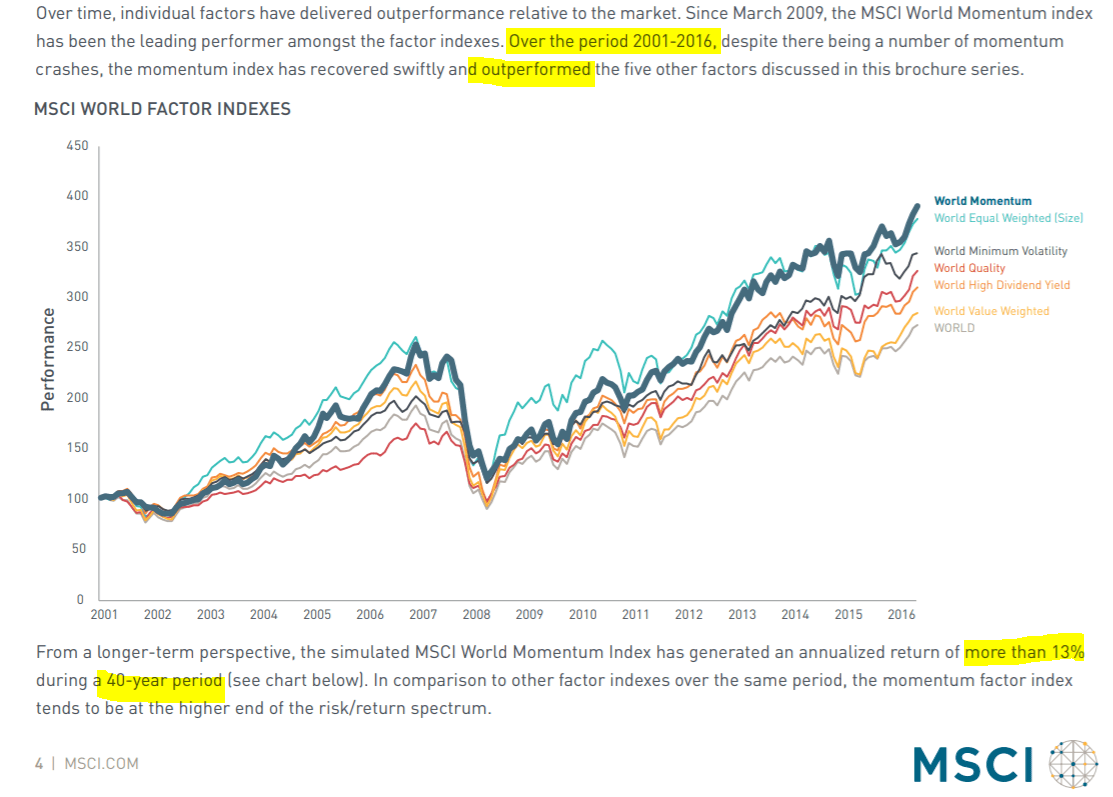

- 應用冠軍策略, 也稱加速雙動能, Accelerating Dual Momentum, 由Gary Antonacci的雙動能系統演化而來,是阿批去Hahow上”小資族ETF狠會賺投資法“學來的. 冠軍策略本身的邏輯是: 在一堆個股中挑最強的持有, 如果都不強就出場, 每個月底用Portfolio visualizer檢查一次, 依訊號作投資組合的切換, 即可獲得超越大盤的獲利.

- 動能因子ETF, 就是把市場裡過去一段時間表現最強的股票挑出來湊成一堆變一支ETF, 可能一次持有個100支, 每一段時間會重新計算挑選. 實際上去看ETF的持股, 裡面還是有強有弱, 所以只要去動能ETF裡去挑最強的強勢股持有, 不就有專業經理團隊, 用Smart beta的技術幫忙先篩選出最強的強勢股了嗎?

1

由於冠軍策略自帶擇強持有+閃過崩盤的屬性, 原始的冠軍策略, 使用指數型ETF, 在2000年及2008年那種環境都是賺錢的(如下圖),如果使用強勢股中的強勢股, 那不是開外掛了?所以阿批決定來實驗這個策略.

1

實驗使用的ETF:

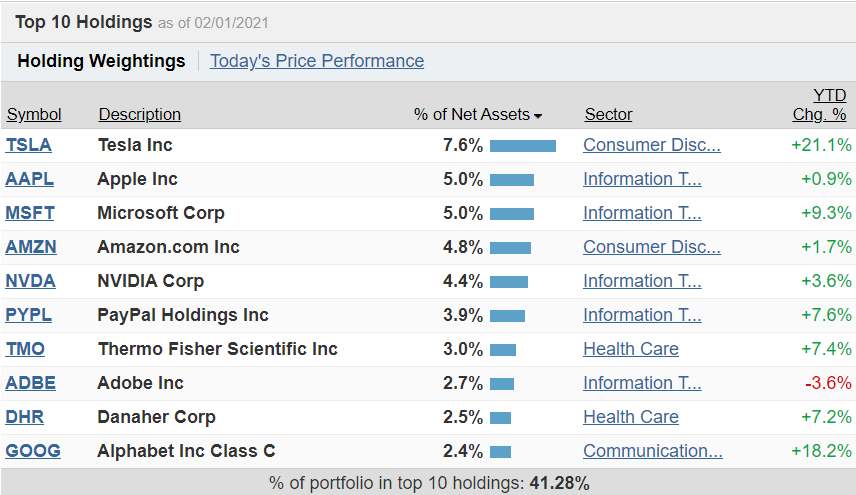

1. MTUM:

iShares MSCI美國動能因子ETF, 追蹤MSCI USA Momentum SR Variant Index, 在美國大型股及中型股中, 從過去6個月及12個月的股價表現中挑出相對強勢的個股, 給它一個動能分數, 再由動能分數以市值加權去算出要買多大比例, 每半年會再平衡一次, 換句話說, 強勢的大型股, 或是非常強勢但不那麼大的中型股就會是MTUM的核心持股, 每半年他會重新算一次, 調整持股.

MTUM前十大持股:

1

2. XMMO:

Invesco標普中型股動能組合ETF, 這支是美國中型股動能ETF, 追蹤MSCI中型400指數中過去12個月股價相對強勢的個股, 給一個動能分數, 再以市價加權決定要買多少.

https://www.moneydj.com/etf/x/basic/basic0003.xdjhtm?etfid=xmmo

XMMO前十大持股:

![Top 10 Holdings

of 02/020021

Holding Weightings

Today:s.Price-Pertormance

Synm

MPWR

SAM

MAS]

CG_NX

QescLi&n

Generac Holdings Inc

SolarEdge Technologies Inc

Monolithic Power Systems Inc

Boston Beer Co Inc Class A

Masimo Corp

Cognex Corp

Quidel Corp

Charles River Laboratories

Internationa...

Bio -Techne Corp

Cable One Inc

% of Net Assets.

4.4%

3.3%

2.6%

2.3%

2.3%

Industrials

Tecnnology

% Of portfolio in top 10 holdings: 28.32%

-3.8%

-0.1%

-3.6%

.318%

-7.8%

Al_LHQlßings](https://mlz8bk93vqkc.i.optimole.com/lCZAJOw-wyRcpRQt/w:780/h:539/q:eco/https://i0.wp.com/yyp-fire.com/wp-content/uploads/2021/02/image-1.png?resize=780%2C539&ssl=1)

4. VGLT:

Vanguard發行的美國長期國債ETF, 基上和TLT是類似的組成, 為這次冠軍策略的出場持有資產.

https://www.moneydj.com/etf/x/basic/basic0003.xdjhtm?etfid=vglt

5. VOO

Vanguard標普500指數ETF,這次用為單一絕對動能開關股.

https://www.moneydj.com/etf/x/basic/basic0003.xdjhtm?etfid=voo

1

1

實驗開始囉!

1

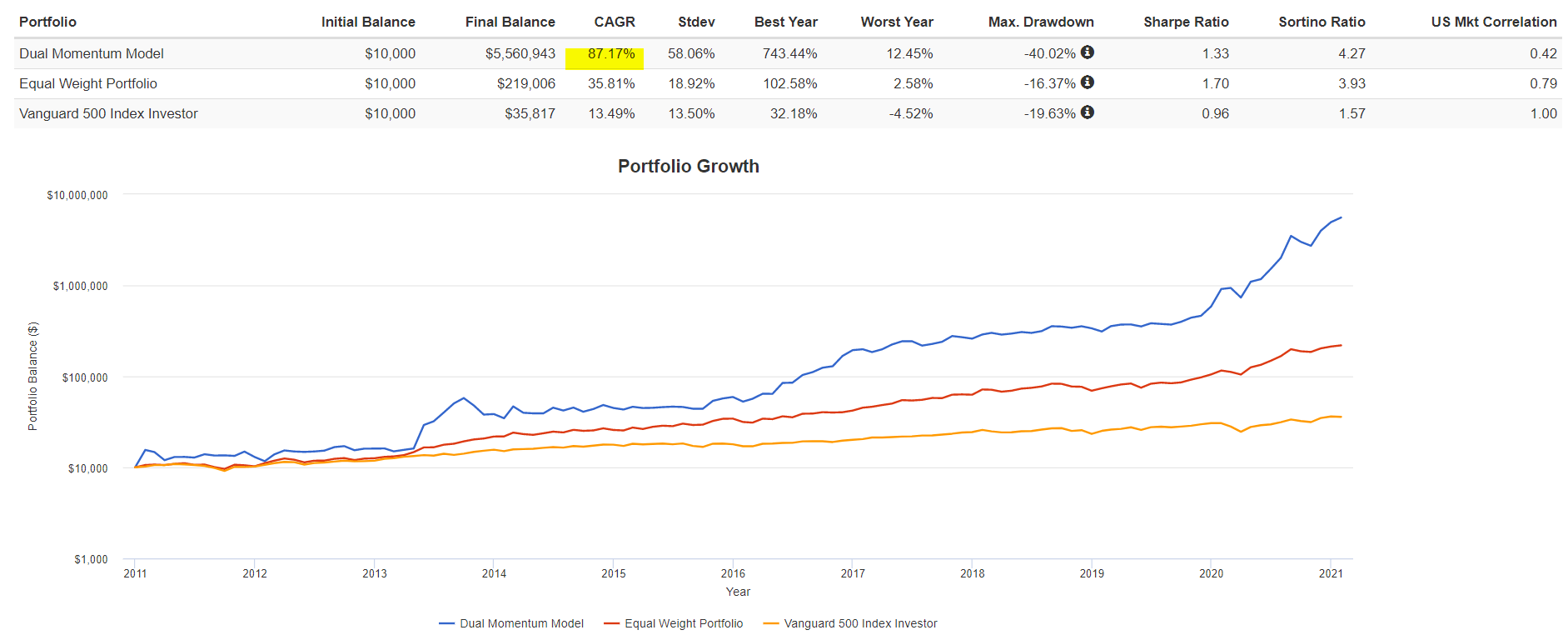

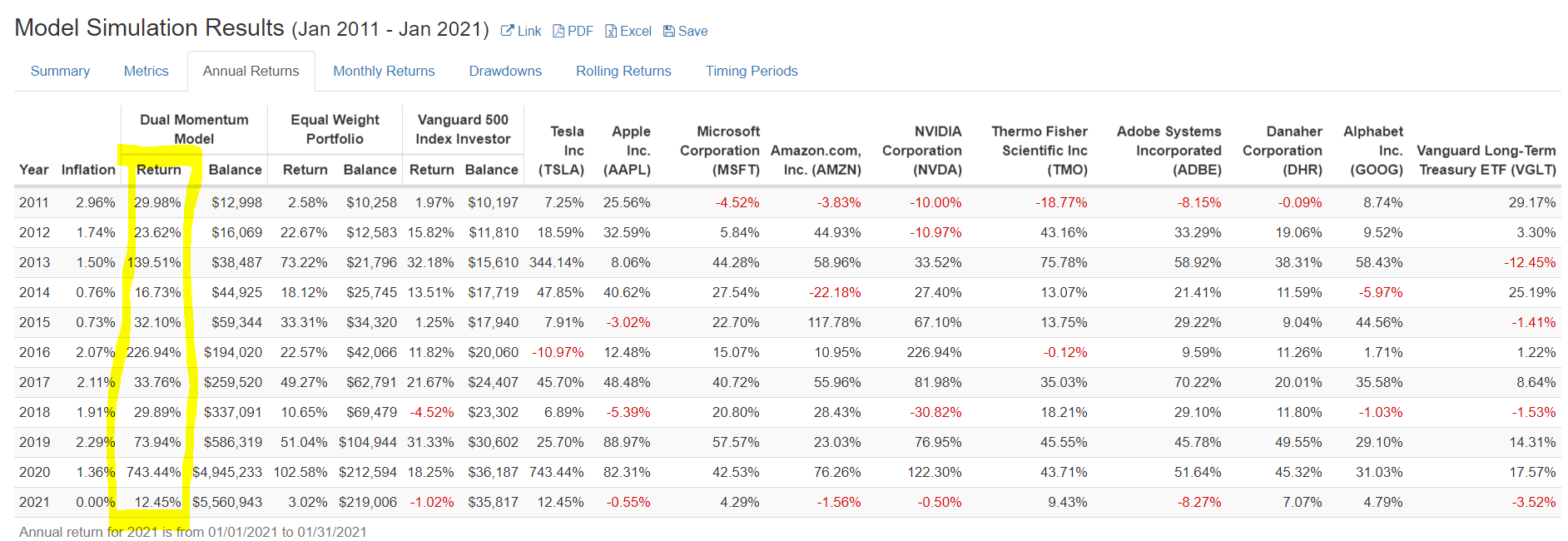

實驗一: MTUM+冠軍策略(股票數9, 持股1, 出場持有VGLT, 一個月看一次, 不使用單一絕對動能)

把MTUM持股的前十名(不含PYPL, 因為可回測時間太短, 先拉掉)丟到冠軍策略裡面, 持股數設1, 可以看到如下的鬼神表現, 不過我覺這樣有點後照鏡, 誰都知道最近幾年FANG+強得跟鬼一樣, 特別是Tesla, 2020年一年漲了700%, 所以再進行實驗二, 用XMMO的表現也一樣嗎?

TSLA AAPL MSFT AMZN NVDA TMO ADBE DHR GOOG

1

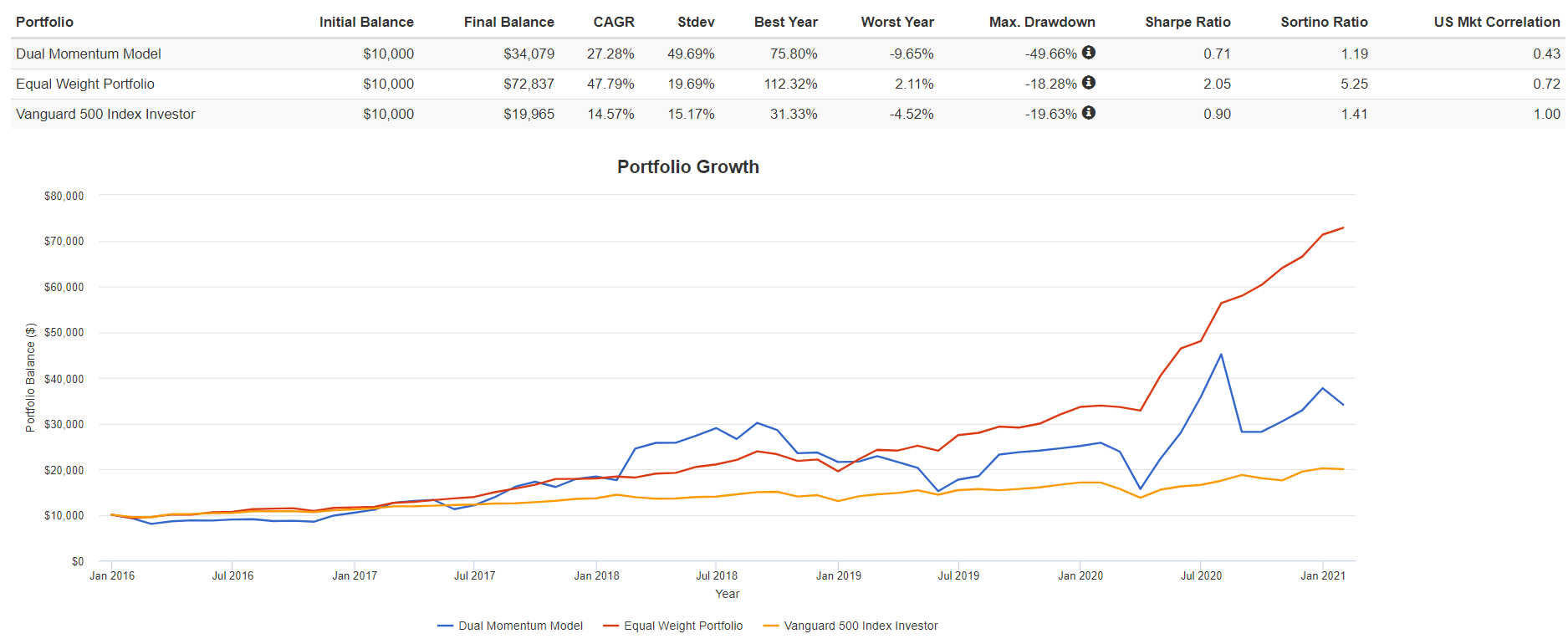

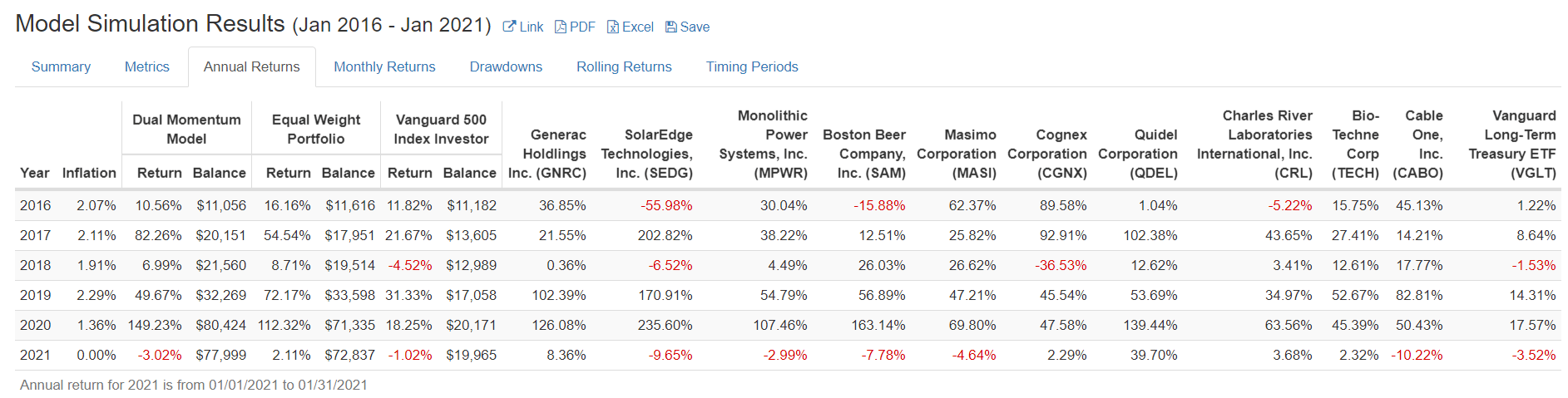

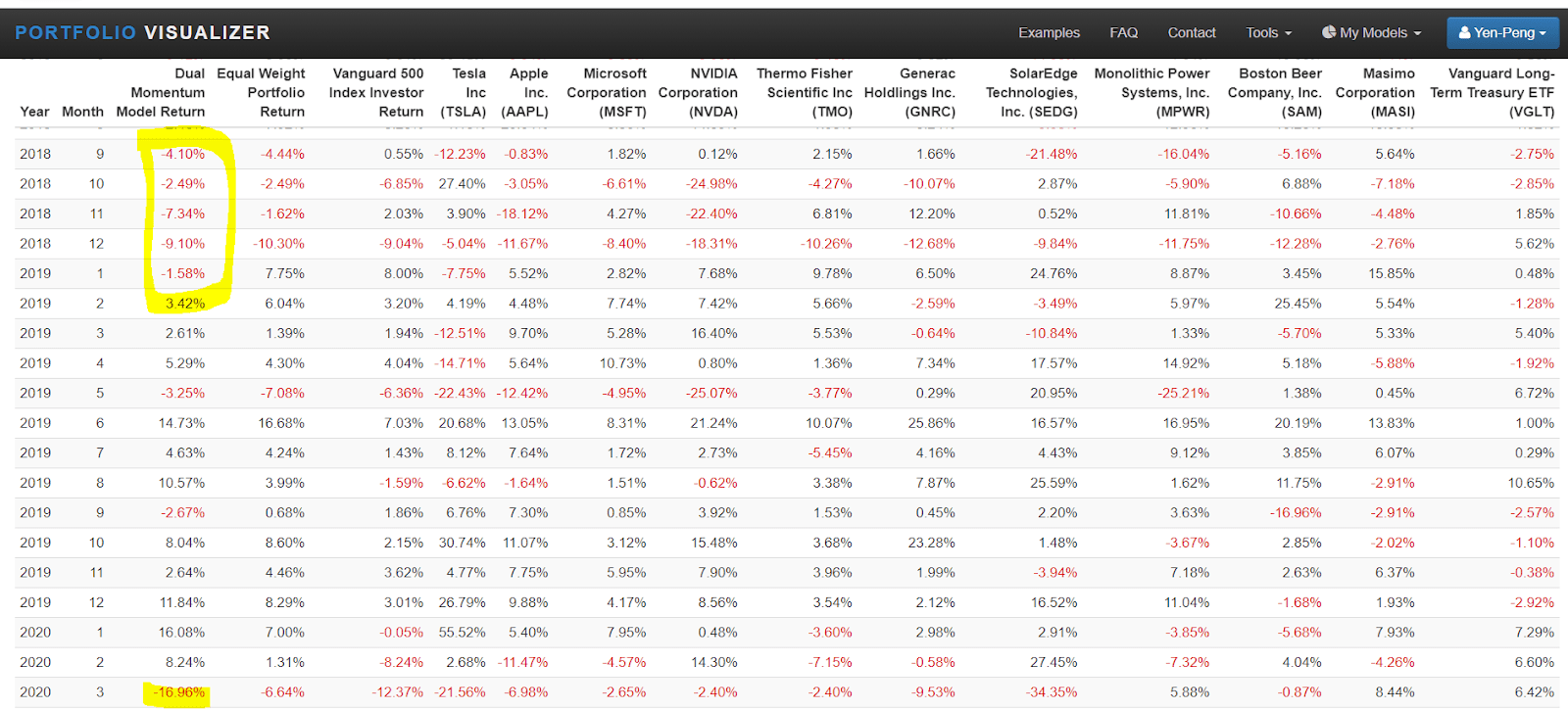

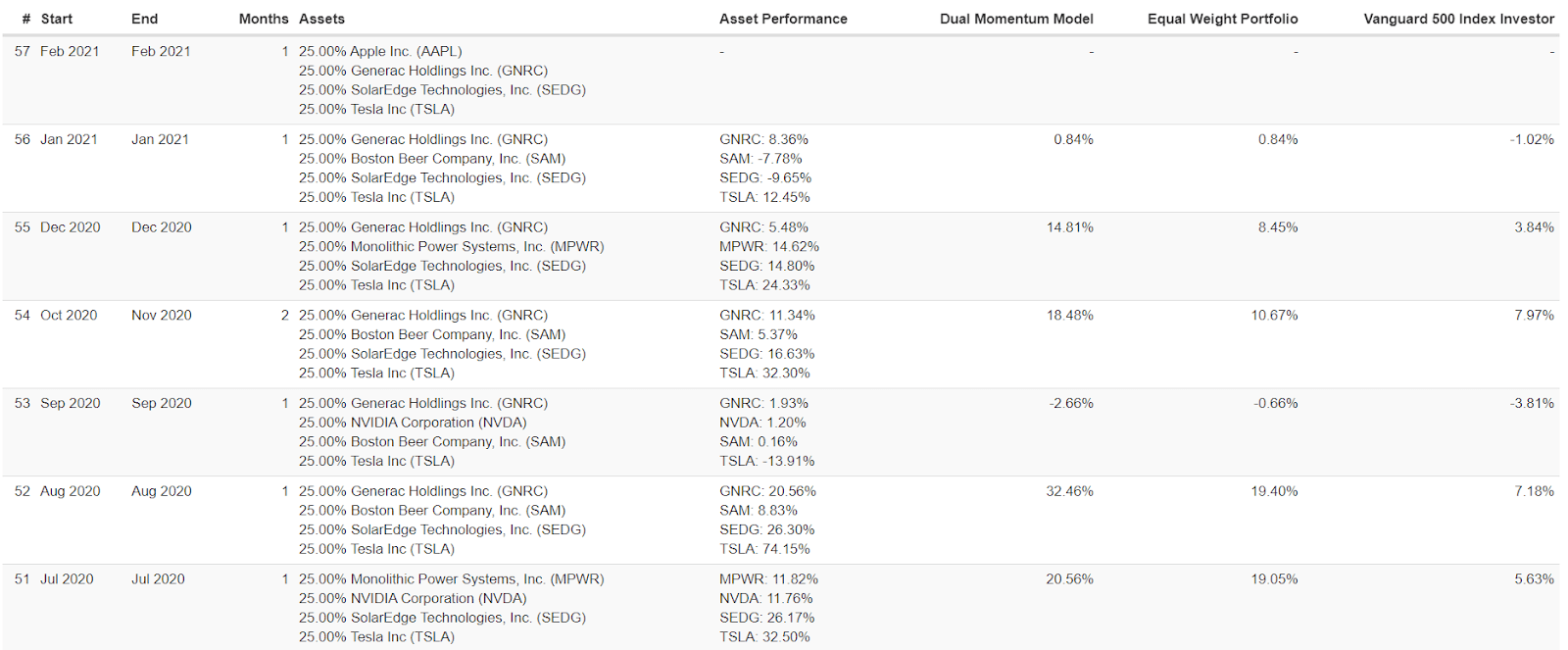

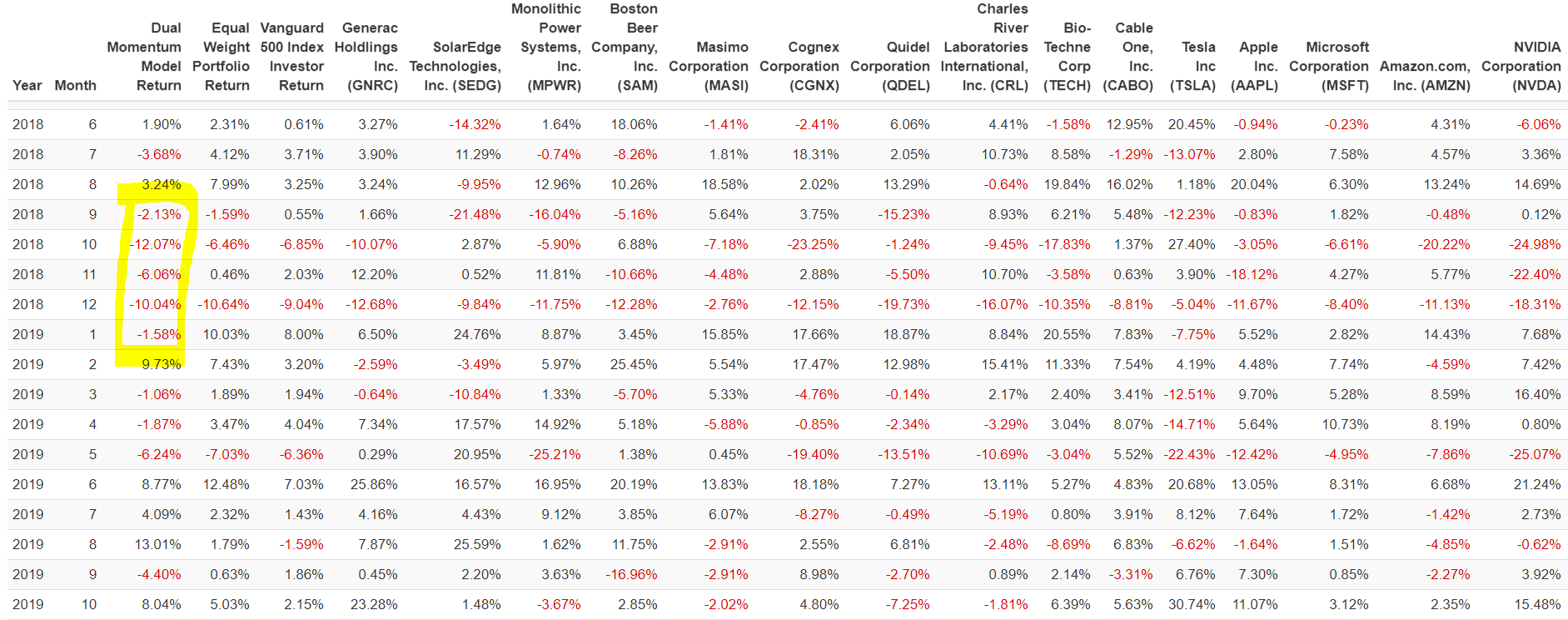

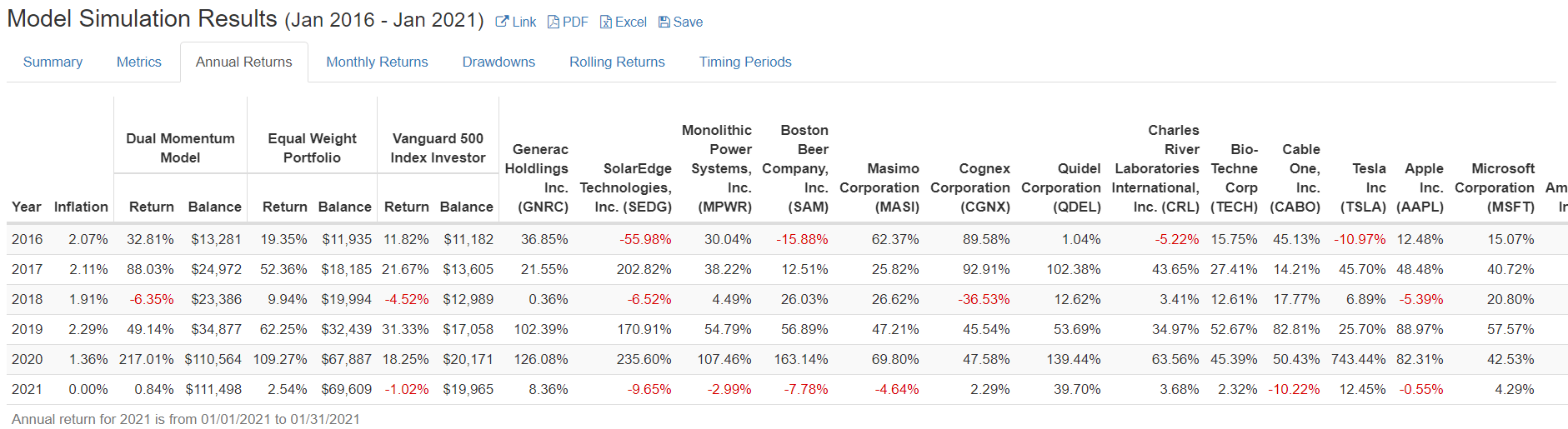

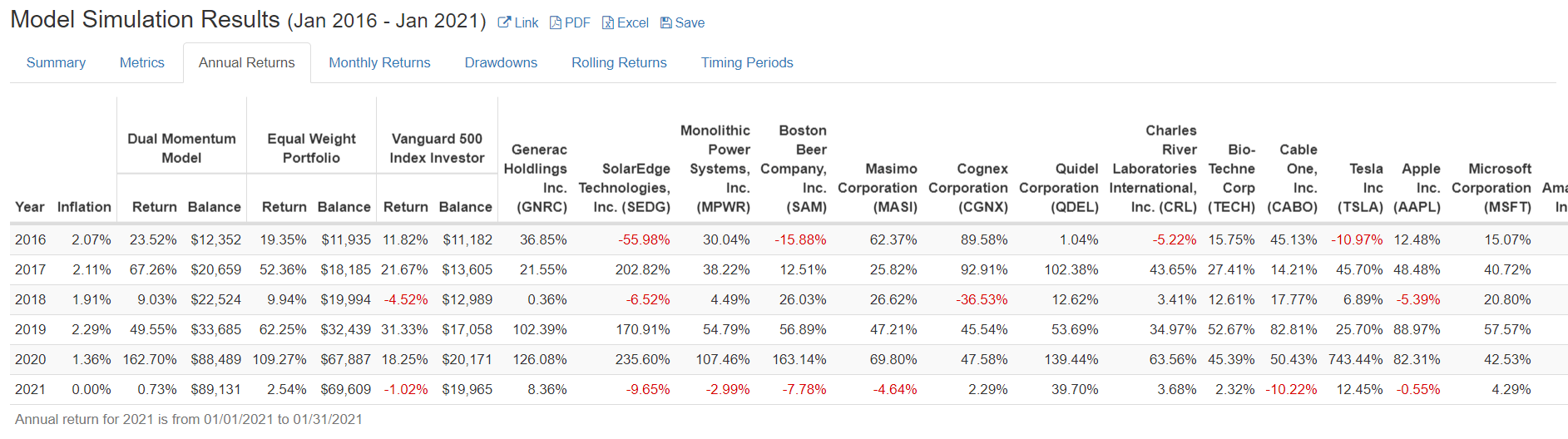

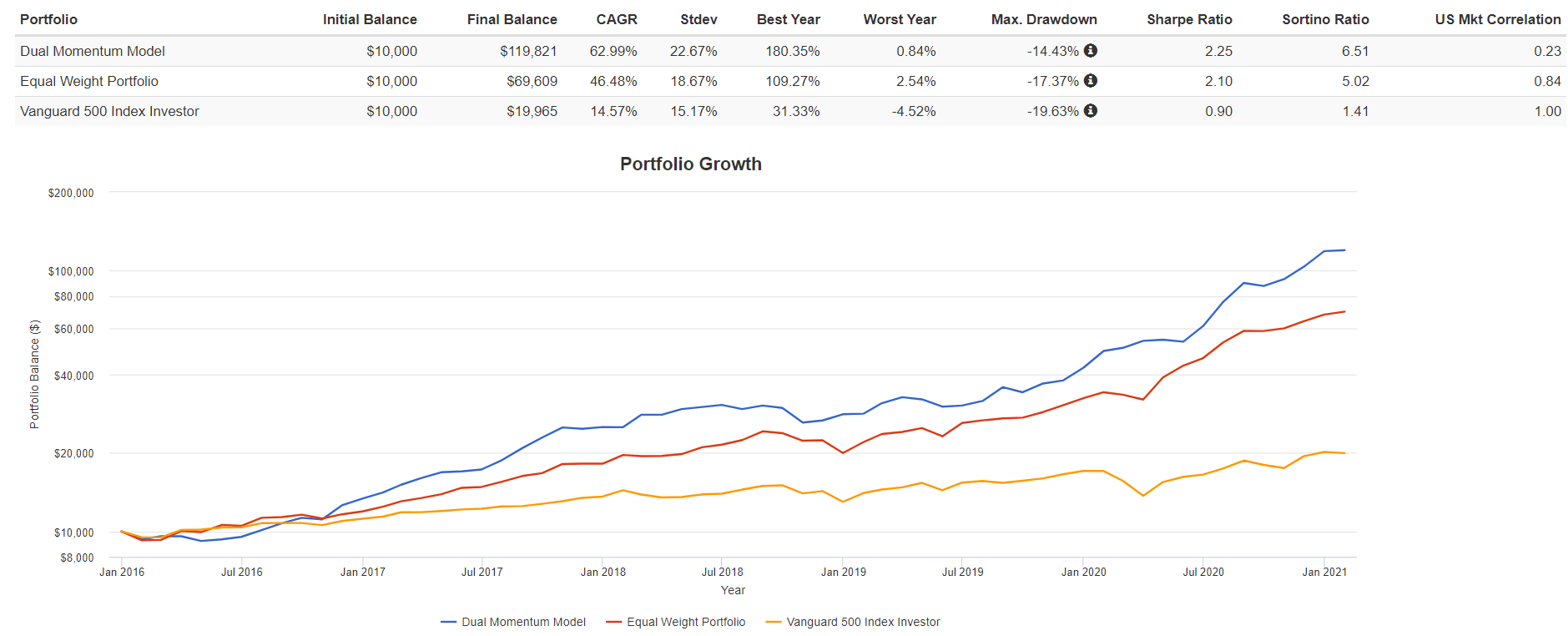

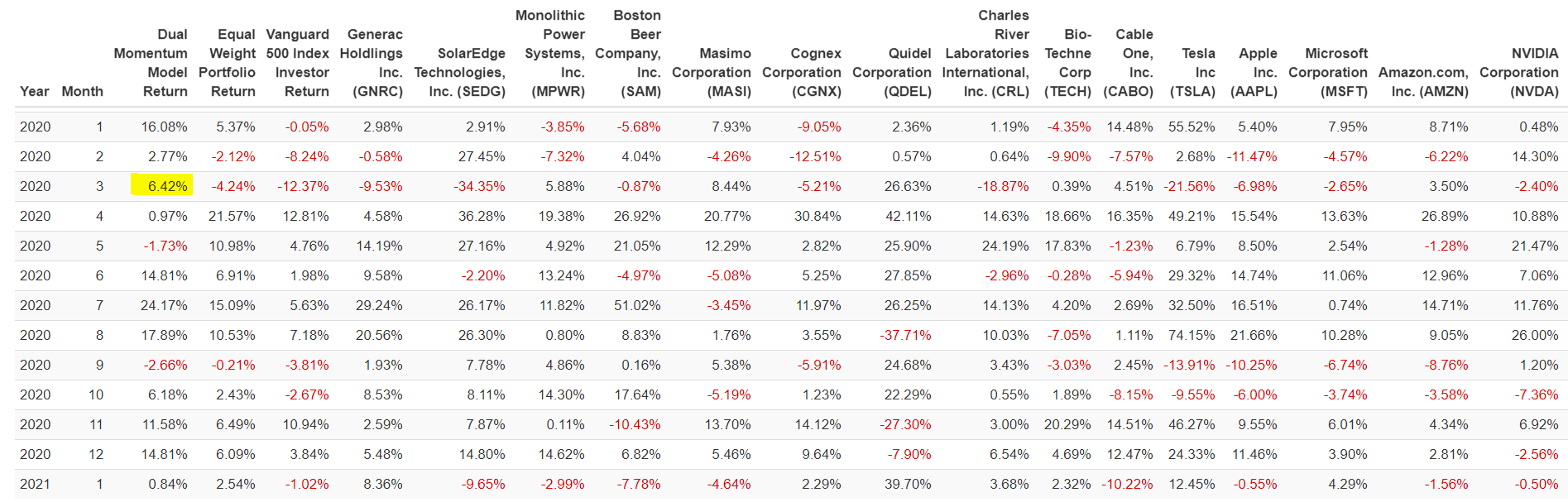

實驗二: XMMO+冠軍策略(股票數10, 持股1, 出場持有VGLT, 一個月看一次不使用單一絕對動能)

把XMMO的前十名持股放進冠軍策略, 一樣持股數設1, 看到的是與MTUM前十名完全不同的光景, 拉回變得很大, 績效還不如平均持股, 由於XMMO是比較新的ETF, 資料只有到2016.

很顯然這個系統在持股單一的狀況下, 會受到個股表現影響而有很大的波動, 甚至會不如平均配置.

GNRC SEDG MPWR SAM MASI CGNX QDEL CRL TECH CABO

1

實驗三: MTUM+冠軍策略(股票數9, 持股4, 出場持有VGLT, 一個月看一次,不使用單一絕對動能)

那….試著把持股變成群組, 改成4試試, 一整組的績效應該要比較平滑一點.

如下圖, 從2011年起, 年化40.85%, 最大拉回-21.94%, 和實驗一相比, 績效有比較低, 不過拉回也平穩得多.

MTUM:TSLA AAPL MSFT AMZN NVDA TMO ADBE DHR GOOG

1

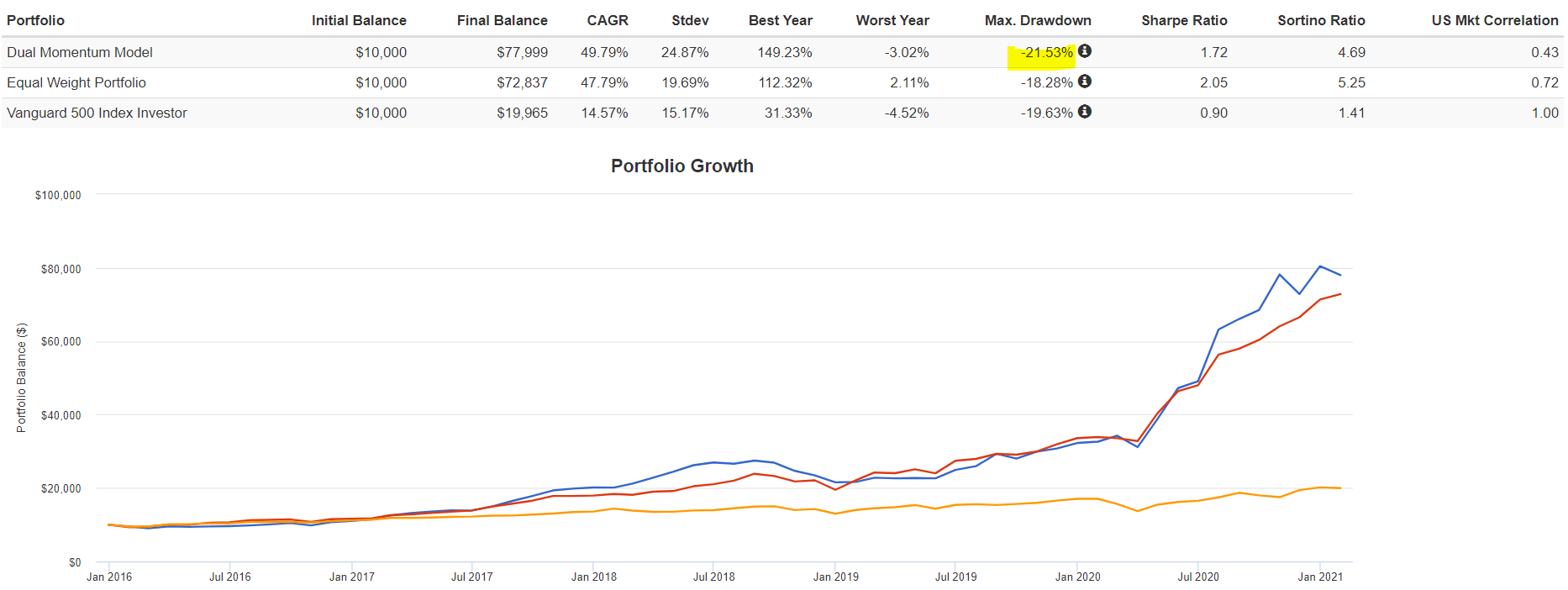

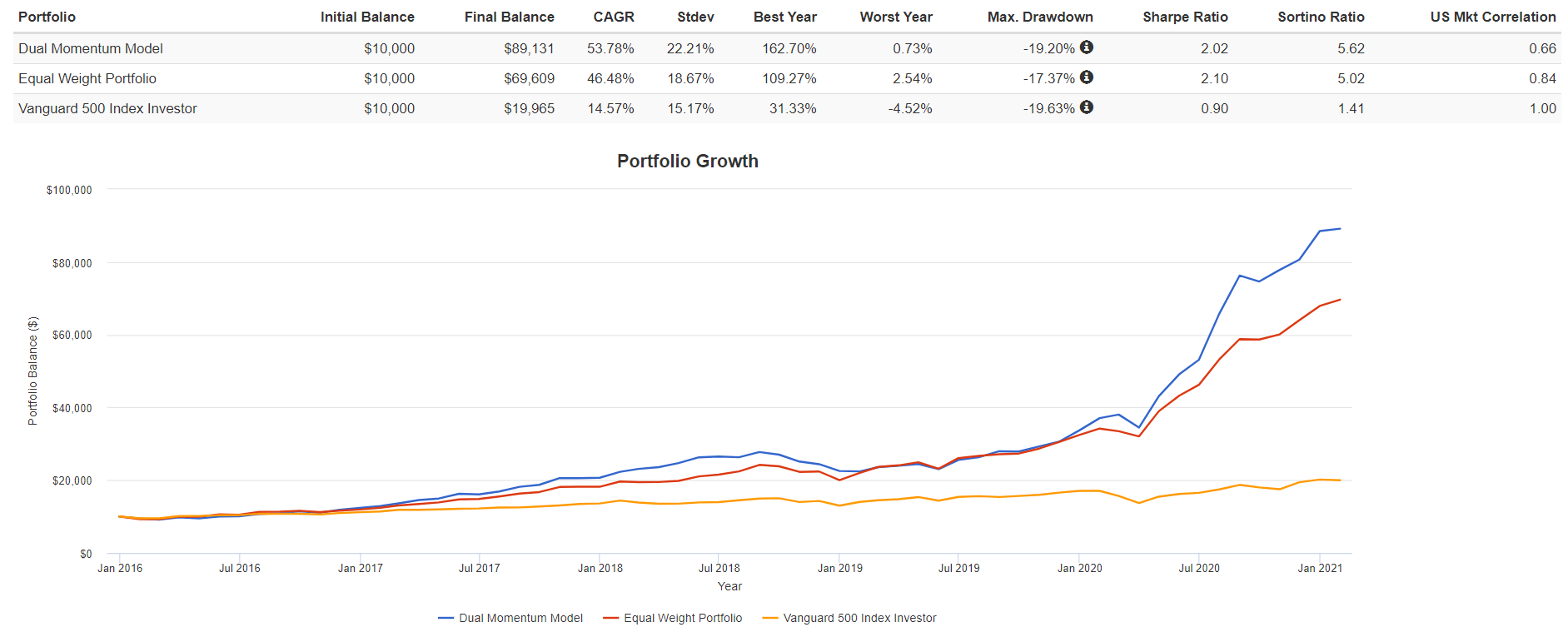

實驗四: XMMO+冠軍策略(股票數10, 持股4, 出場持有VGLT, 一個月看一次,不使用單一絕對動能)

XMMO的實驗顯示出類似的結果, 拉回變得比實驗二的-49.66%平穩許多, 年化報酬也從27.28%來到49.79%, 整體結果和平均持股(Equal weight Portfolio)是接近的.

XMMO: GNRC SEDG MPWR SAM MASI CGNX QDEL CRL TECH CABO

1

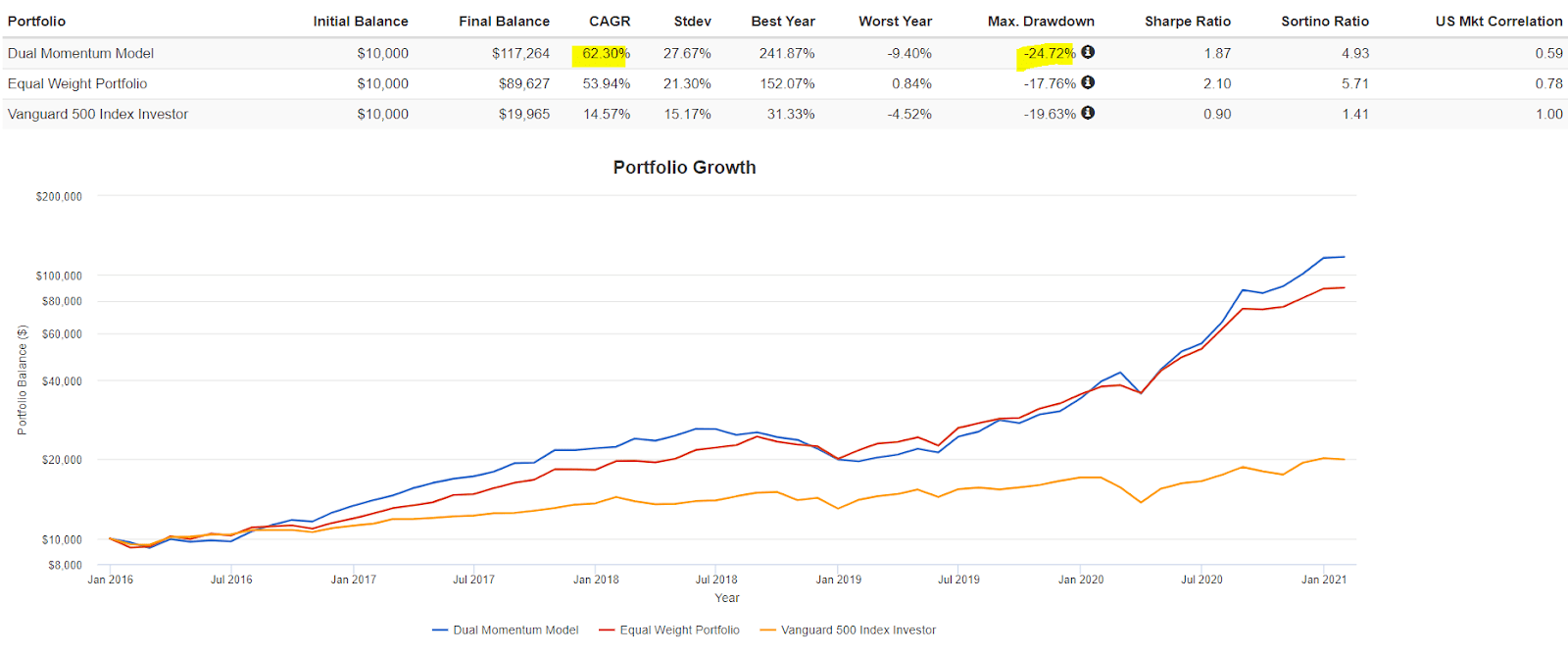

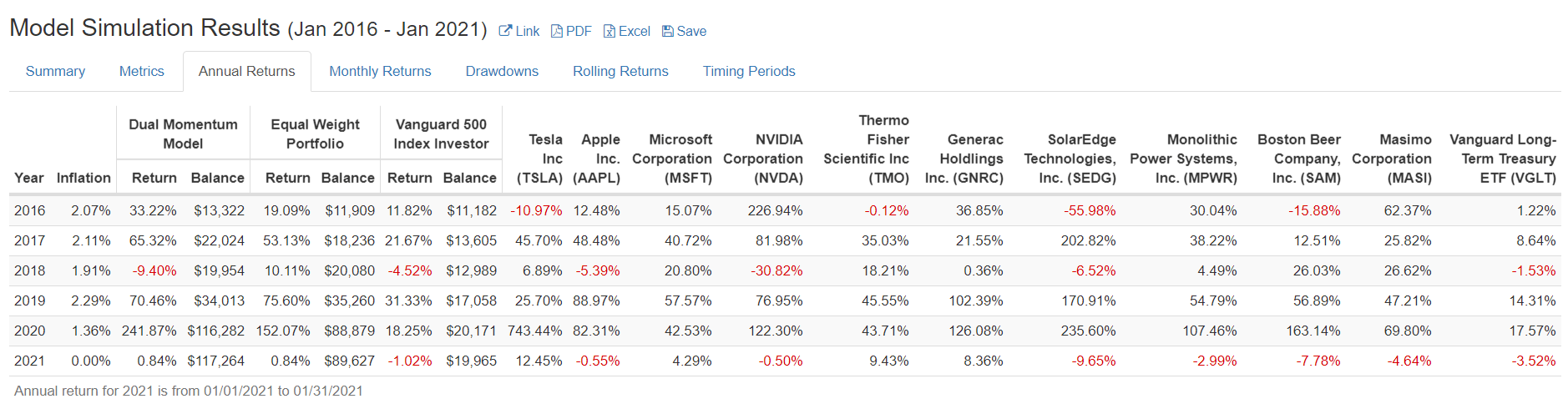

實驗五: XMMO前5名+MTUM前5名+冠軍策略(股票數10, 持股4, 出場持有VGLT, 一個月看一次,不使用單一絕對動能)

那麼, 如果今天大型股威風不再, 輪到中型股當家了呢? 或者反過來, 只用大型股或只用中型股的策略不就吃虧了?

我們試著把二支ETF的前五大持股放在一起實驗, 看能不能兼顧到大中型股.

MTUM 前5名+XMMO前5名, 持股4支: TSLA AAPL MSFT NVDA TMO GNRC SEDG MPWR SAM MASI

結果看起來滿殺的, 波動也不會太誇張,

2018和2020年初的拉回, 要有大幅震盪的心理準備, 如果在資產配置裡只放個10%, 其實也不會很痛.

持股內容看起來滿平衡的, 每個月抱4支, 也不會很難換.

1

實驗六: XMMO前10名+MTUM前10名+冠軍策略(股票數19, 持股4, 出場持有VGLT, 一個月看一次,不使用單一絕對動能)

結果跟實驗五差不多.

GNRC SEDG MPWR SAM MASI CGNX QDEL CRL TECH CABO TSLA AAPL MSFT AMZN NVDA TMO ADBE DHR GOOG

拉回的時候對心性是大考驗.

1

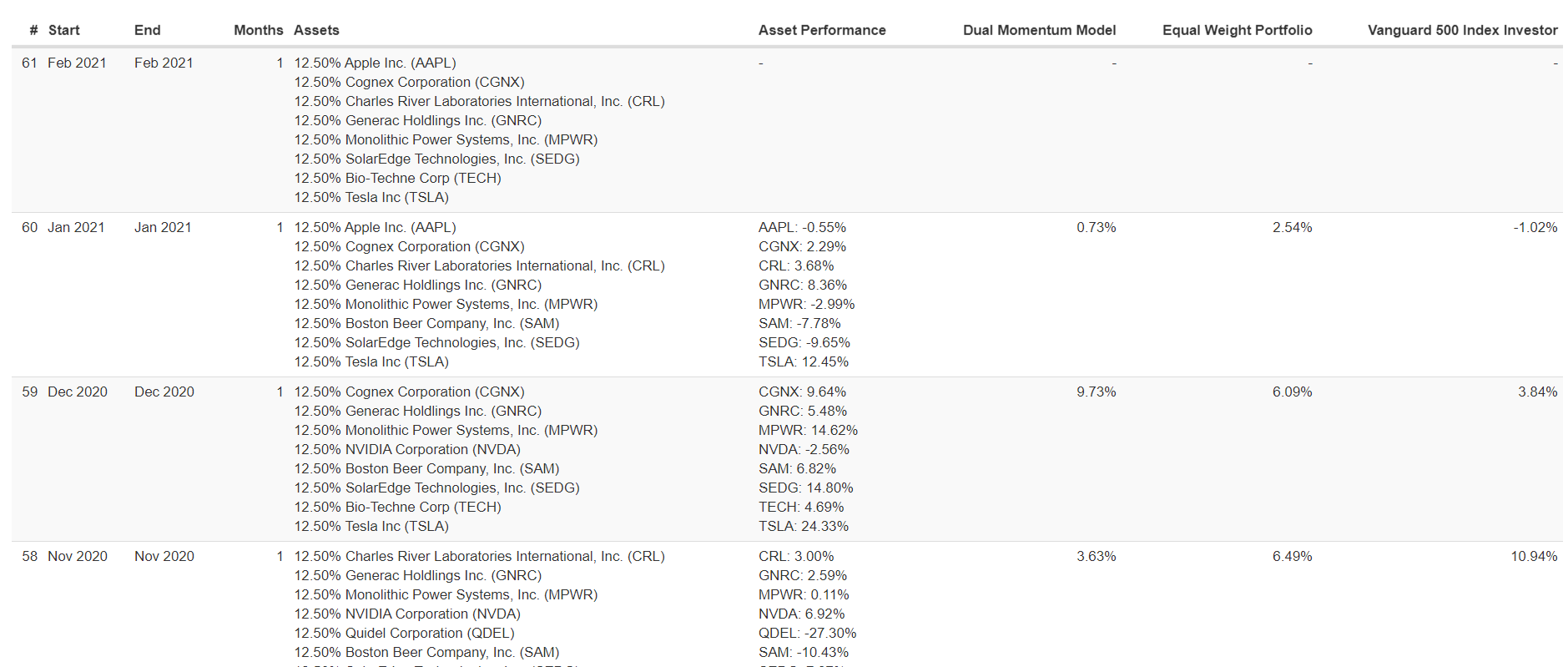

實驗七: XMMO前10名+MTUM前10名+冠軍策略(股票數19, 持股8, 出場持有VGLT, 一個月看一次,不使用單一絕對動能)

持股數可以不要4支嗎? 為了讓差異明顯一點, 我們直接把持股數*2變成8, 結果看起來也不錯,特別沒有一年是賠錢的, 但這樣每個月要比對跟再平衡8支個股, 也是一番工夫.

GNRC SEDG MPWR SAM MASI CGNX QDEL CRL TECH CABO TSLA AAPL MSFT AMZN NVDA TMO ADBE DHR GOOG

1

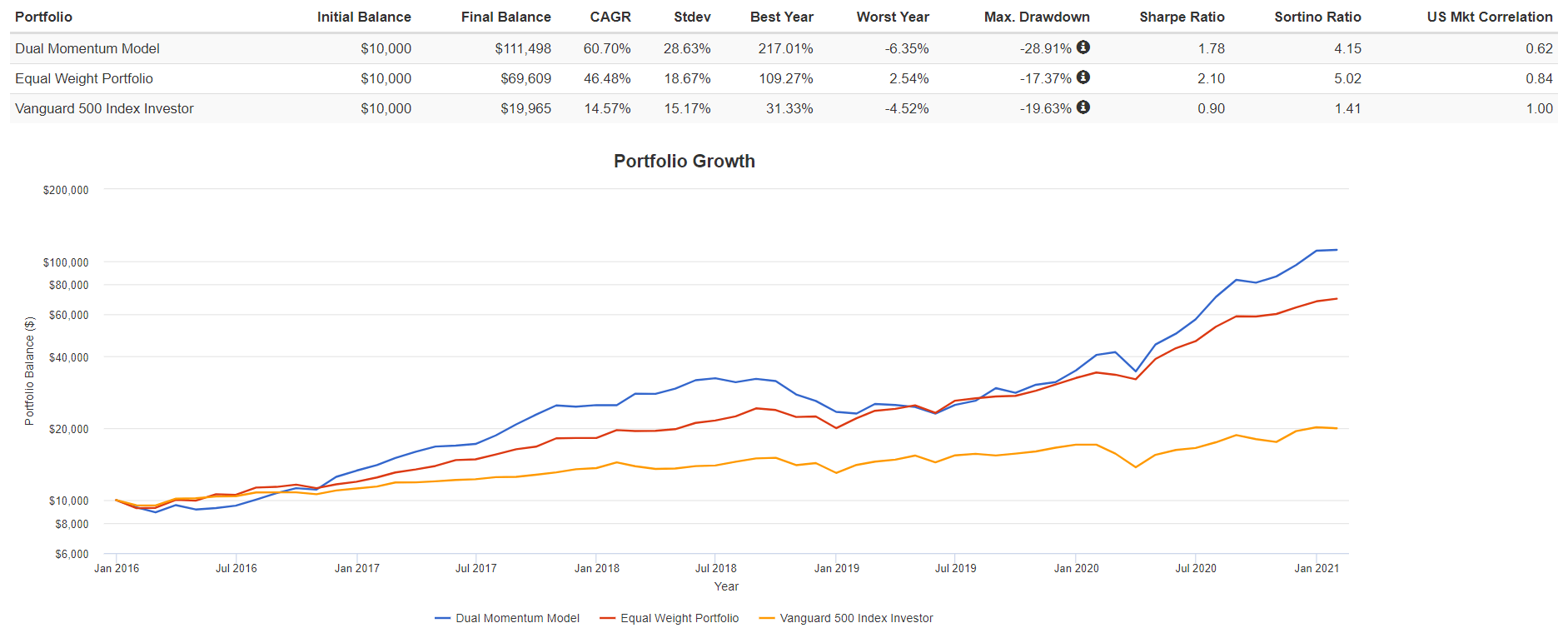

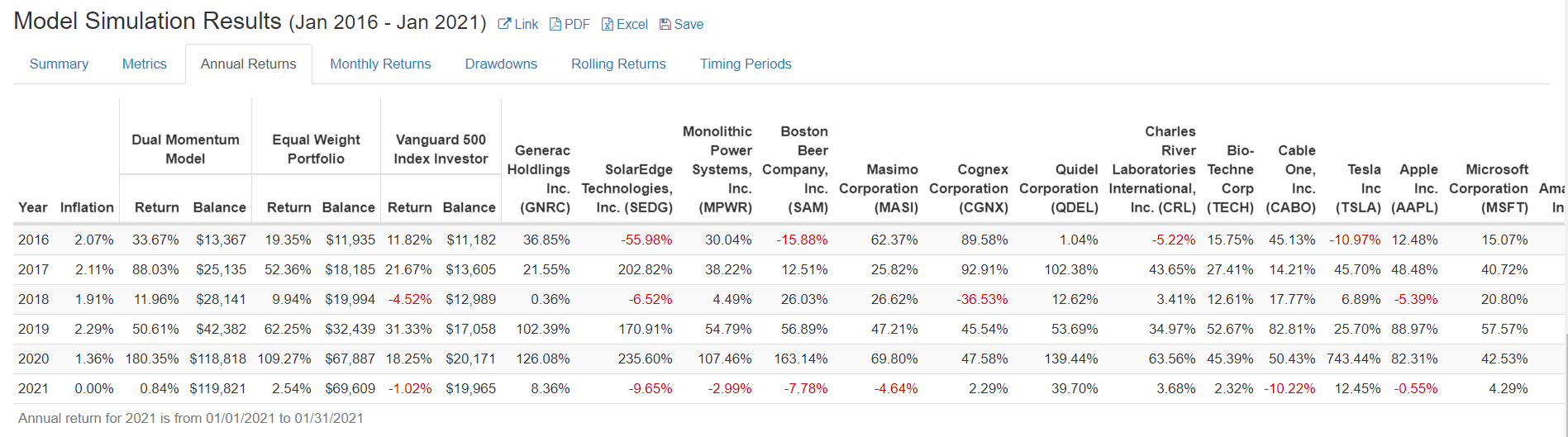

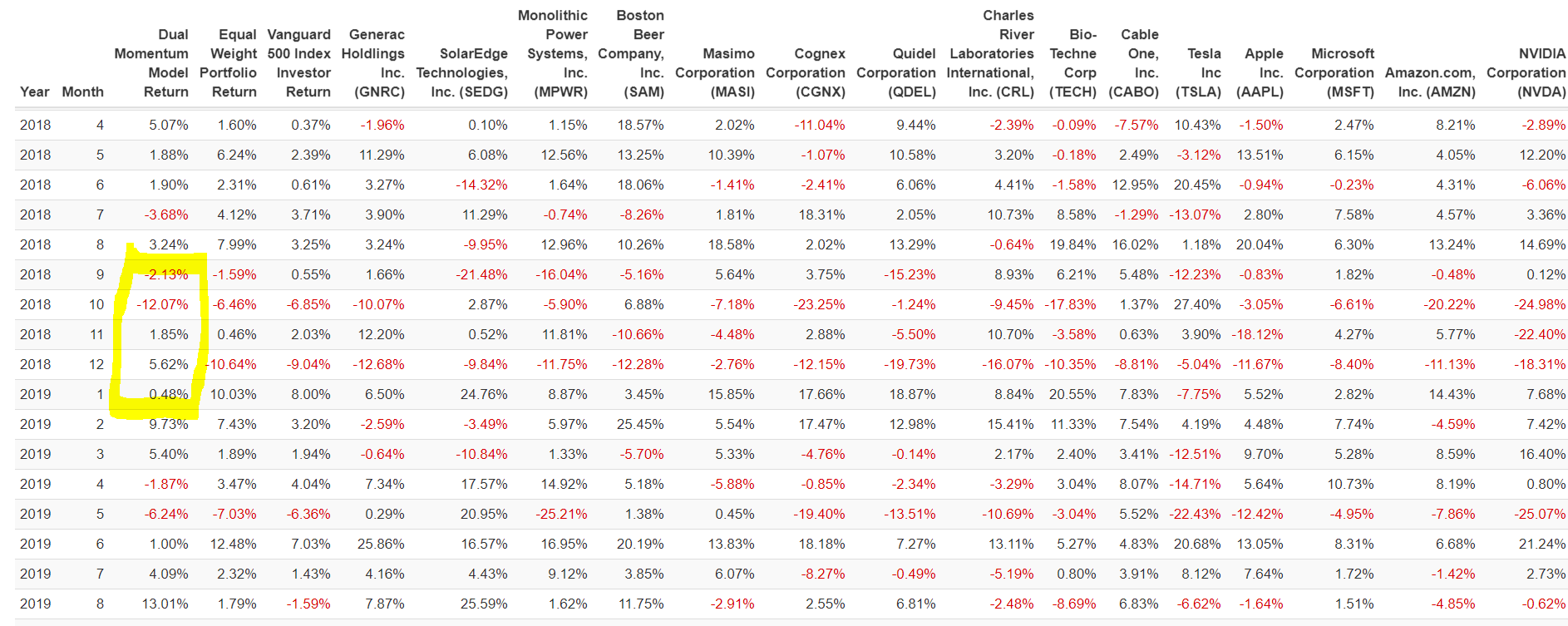

實驗八: XMMO前10名+MTUM前10名+冠軍策略(股票數19, 持股4, 出場持有VGLT, 一個月看一次,使用單一絕對動能:VOO) 就是它了!!

加入單一絕對動能當作總開關, 只要VOO(SP500)不好, 就全部持股換成VGLT.

由結果來看可以閃得掉大盤反轉時的輪跌, 拉回幅度變得比大盤還要小的-14.43%, 年複利報酬率62.99%.

GNRC SEDG MPWR SAM MASI CGNX QDEL CRL TECH CABO TSLA AAPL MSFT AMZN NVDA TMO ADBE DHR GOOG

這幾年沒有大空頭, 不過在SP500大盤賠的2018年, 實驗八仍然是獲利的.

實驗六中2018年9月到2019月的拉回在實驗八得到大幅改善, 因為持股換成VGLT, 閃過了下跌.

2020年初也是安全下椿, 看來就是這個了!

結論

- MTUM和XMMO分別是美國大型及中型的動能型投資ETF, 選股的邏輯是買市場中表現最強勢的股票, 每半年重算一次, 善用的話可以省去大把選股的時間, 採用的話要注意上官網看再平衡後前10名的持股有沒有更換.

- 冠軍策略用在個股可能表現差異會很大, 因為少數個股相較於指數ETF更不容易掌握, 不過是以一個群組的方式持有, 就可以中和掉個股的波動.

- 阿批個人偏向用實驗八, 有夠多的股票來自大型股及中型股, 去給冠軍策略選, 分散性較好, 萬一有幾支同時狀況不好, 有夠大的樣本可以換, 持股4支就好, 不然每個月光重新平衡就要花一番心力, 再來個股波動較指數ETF為大, 使用單一絕對動能, SP500表現不好時全部換成VGLT, 減少心臟病發的機會.

- 執行時的價位一定會有誤差, 因為沒有人能真的用當月的收盤價進場(訊號還沒出來), 再來實際執行時會有滑價和買不滿整股的問題, 還有若是個股成交量很小, 有可能會換股不會那麼順利(若資本28億美金的XMMO都買得滿部位, 沒道理小散戶會有流動性問題才是), 若有能力用程式處理更佳.

- 使用時需算好部位的風險, 拉回的金額要是自己能承受的才行, 對阿批來說, 任何新的投資, 不管再有把握, 會投的資金都會控制在10%左右, 這樣就算失敗不會造成大的資產減損, 成功向上的空間滿可觀.

- Portfolio visualizer的訊號要付一個月19 USD給它, 可以自己去網路爬蟲來複製, 不過不建議就是了, 畢竟一個資金規模以上, 只要一個轉換時機不一樣, 差的數就會遠遠大過一個月 19 USD, 不要因小失大比較好.

- 以上只是個人的實驗, 並非投資買賣的建議, 再著過去的績效不代表未來, 回測模型的結果也可能只是幻覺, 如果要依此模式進場, 還需自行研究過喔.

- 如果各位看倌有耐心看到這裡, 想必也發現了, 一個組合裡只有4支持股, 在沒有漲跌幅限制的美股還是有他的風險在, 下面這篇, 看過了老師的推薦書目, 針對這個部份做了回測及修正, 有興趣也可看一下.

延伸閱讀: [賺贏大盤的動能投資法] 讀書心得及實驗

一堂必上的課

對於有在投資美股ETF的人, 阿批會強烈建議你一定要去上Cash和Jimmy的這堂”小資族ETF狠會賺投資法“, 原因是Cash 接觸程式交易、智能交易長達數十年,已協助超過百組客戶架構交易系統,也在多所大學與期貨商擔任講師。 Jimmy 擁有多年量化操盤經驗,開發過破百隻期貨,外匯交易策略,對策略管理與交易系統整合有深入研究,操作千萬以上資金。

這樣的人看待ETF投資的觀點, 肯定和市面上普遍告訴大家要被動投資、賺取市場報酬有非常有趣的差異, 看看做量化交易的人如何看待投資也是挺有意思.

阿批原來也只是抱著看看的心情, 看了之後才發現, “原來ETF可以這樣做….那麼簡單, 一個月才看一次, 報酬可以超越市場, 風險才一半..”

哇靠….我報酬率每年多幾個百分點, 還可以閃過金融海嘯….學費算什麼…

而且原來Portfolio visualizer還能這樣用…Timing Model那個選項之前想都沒想過..原來可以這樣做..

就算沒想要做比較進階的模型, 學到冠軍策略的原始版也夠本了!!

投資自己的腦袋, 不會錯!

2 comments

[…] 延伸閱讀: 真的假的? 1個年複利報酬60%的懶人美股及美股ETF投資組合!? […]

[…] 延伸閱讀: 真的假的? 真的假的? 1個年複利報酬60%的懶人美股及美股ETF投資組合!? […]

Comments are closed.