在<<賺贏大盤的動能投資法>>裡, 身為避險基金經理人的作者Andreas F. Clenow示範了如何製作一個用個股組成的動能投資組合:

- 要有一個選股池, 作者用S&P 500–>這裡阿批會用MTUM這支Smart-beta ETF.

- 有一個篩選準則, 作者用近90天漲最多的前30名.–>由於MTUM已經是近12個月及近6個月漲最多的個股挑出來, 並經過波動處理, 給予動能分數並加權的結果, 所以我們就直接挑每月前10支就好了.

- 決定要買多少: 作者用ATR去調整權數, 這裡阿批就直接每支給他10%.

- 再平衡: 作者是每月再平衡, 阿批也是, 每個月第一個交易日, 依照前月底公告的持股前十名調整持股.

- 閃避系統性風險的某種機制: 書中是用200日均線, 破線就只出不進; 在這裡阿批用冠軍策略(Accelerating momentum, ADM)的絕對動能, 以MTUM為單一絕對動能, 達到條件時十支個股直接出場, 改持有出場資產, 可以是現金, 也可以是與股市負相關的資產, 像是美國國債, 這回我們用TMF(3倍作多的20年國債), 讓組合在股市有系統性風險時也可以賺一筆.

- 個股賣出機制: 作者有用100日均線做個股的賣出機制, 這裡阿批不用.

作者有避險資金的資料源、程式能力, 可以找到得到S&P500過去20年, 每90天漲最多的個股, 還計入分割、配息、下市等資訊….

阿批只有Excel、Portfolio visualizer和網路上的公開資料, 也能行.

延伸閱讀: [賺贏大盤的動能投資法] 讀書心得及實驗

關於什麼是冠軍策略(Accelerating dual momentum, ADM), 可以讀下面這篇:

延伸閱讀: [雙動能投資]-讀書心得及摘要

為什麼用TMF可以讀這篇:

延伸閱讀: [諾貝爾獎得主的獲利公式LIFE CYCLE INVESTING]讀書心得+一個低風險(?)的槓桿投資組合

1

具體作法:

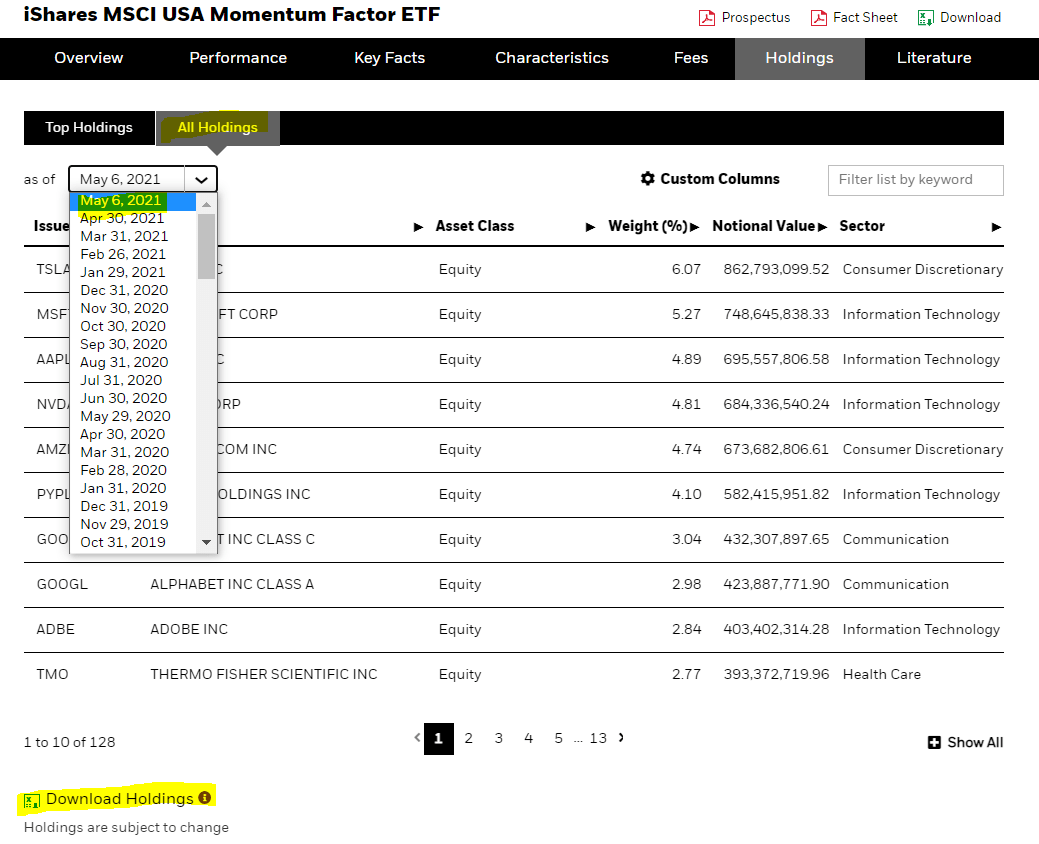

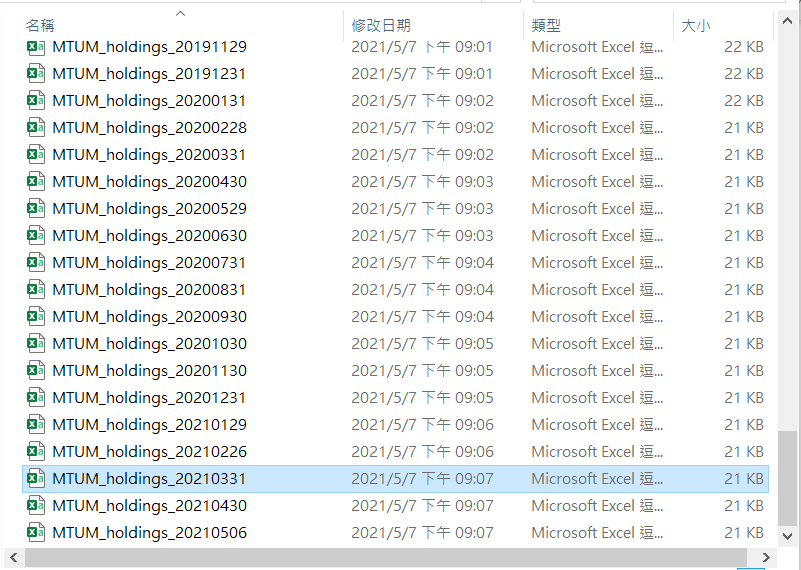

1. 先找到MTUM過往每月的持股前10名資料: 到Black Rock網站, 有MTUM每月的持股資料, 全部都給他抓下來.

1

2. 打開下載的檔案, 找出每月的前十大持股, 如下2021/3/31的持股前十名是TSLA, MSFT, NVDA, AMZN, AAPL, PYPL, GOOG, GOOGL, ADBE, TMO.

但GOOG和GOOGL其實都是Google, 只是一個有投票權, 一個沒有, 兩個都選會變成Google在組合中的權重比其它股多一倍, 所以剔掉其中任一個, 由第11名的DHR遞補.

![iShares MSCI USA Momentum Factor ETF

Fund Holdings as of

Inception Date

Shares Outstanding

Bond

cash

Issuer Ticker

TSLA

MSFT

AAPL

AMZN

NVDA

PYPL

ADBE

TMO

GOOG

GOOGL

DKR

CRM

31-Mar-21

16-Apr-13

Name

TESLA INC

Asset Clas Weight (7 Price

Equity

MICROSOFT CEquity

APPLE INC Equity

AMAZON COL Equity

NVIDIA CORP Equity

PAYPAL HOLIEquity

ADOBE INC Equity

THERMO FISH Equity

ALPHABET IN' Equity

ALPHABET Equity

[F]NAHER CO Equity

SALESFORCE.(Equity

6.33

5.15

4.77

4.59

4.58

4.09

2.69

2.78

2.74

2.72

2.39

2.17

667.93

235." #

122.15 #

3,094.08

533.93 #

24284 #

475.3?

456.33 #

2,068.63

2,062.52 #

211.67](https://mlz8bk93vqkc.i.optimole.com/wW_KYjQ-q2yQ1rh4/w:576/h:597/q:eco/https://i1.wp.com/yyp-fire.com/wp-content/uploads/2021/05/image-11.png?resize=576%2C597&ssl=1)

1

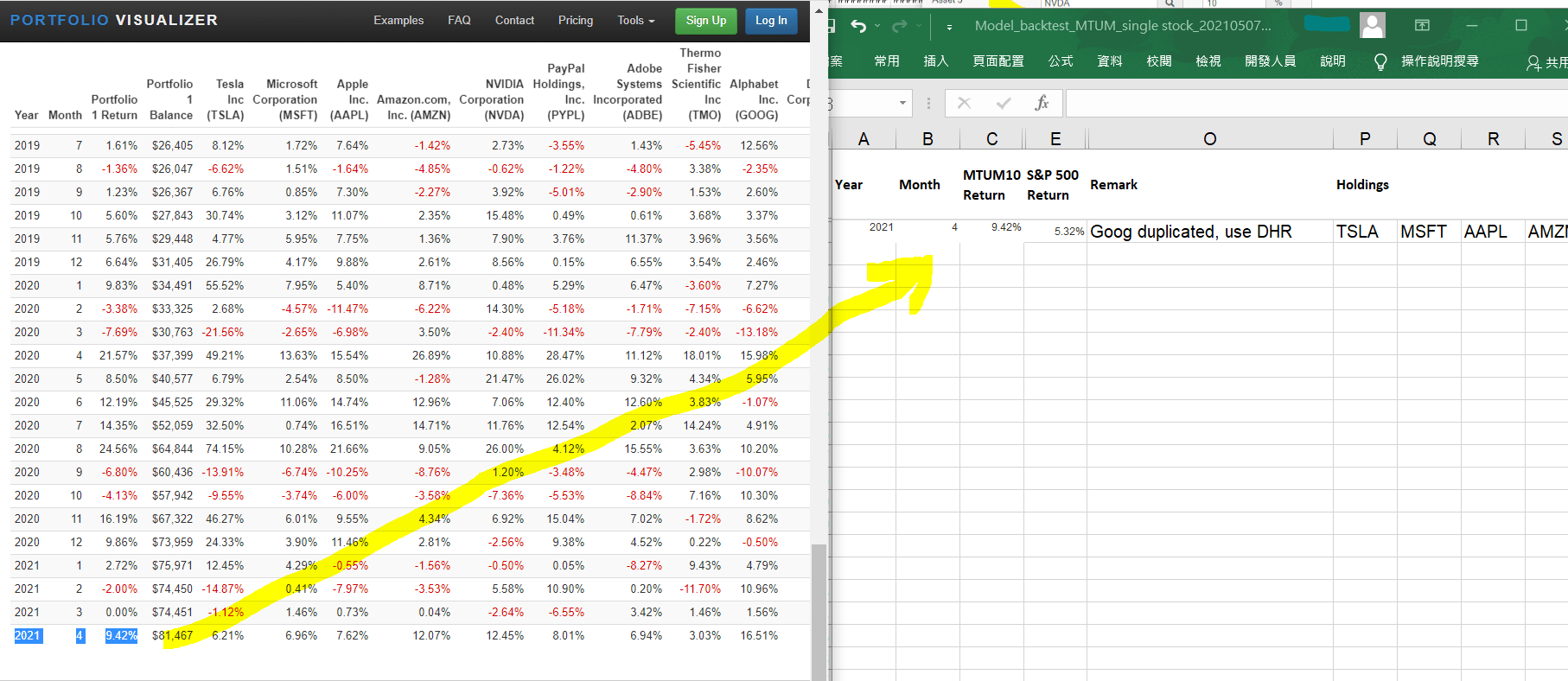

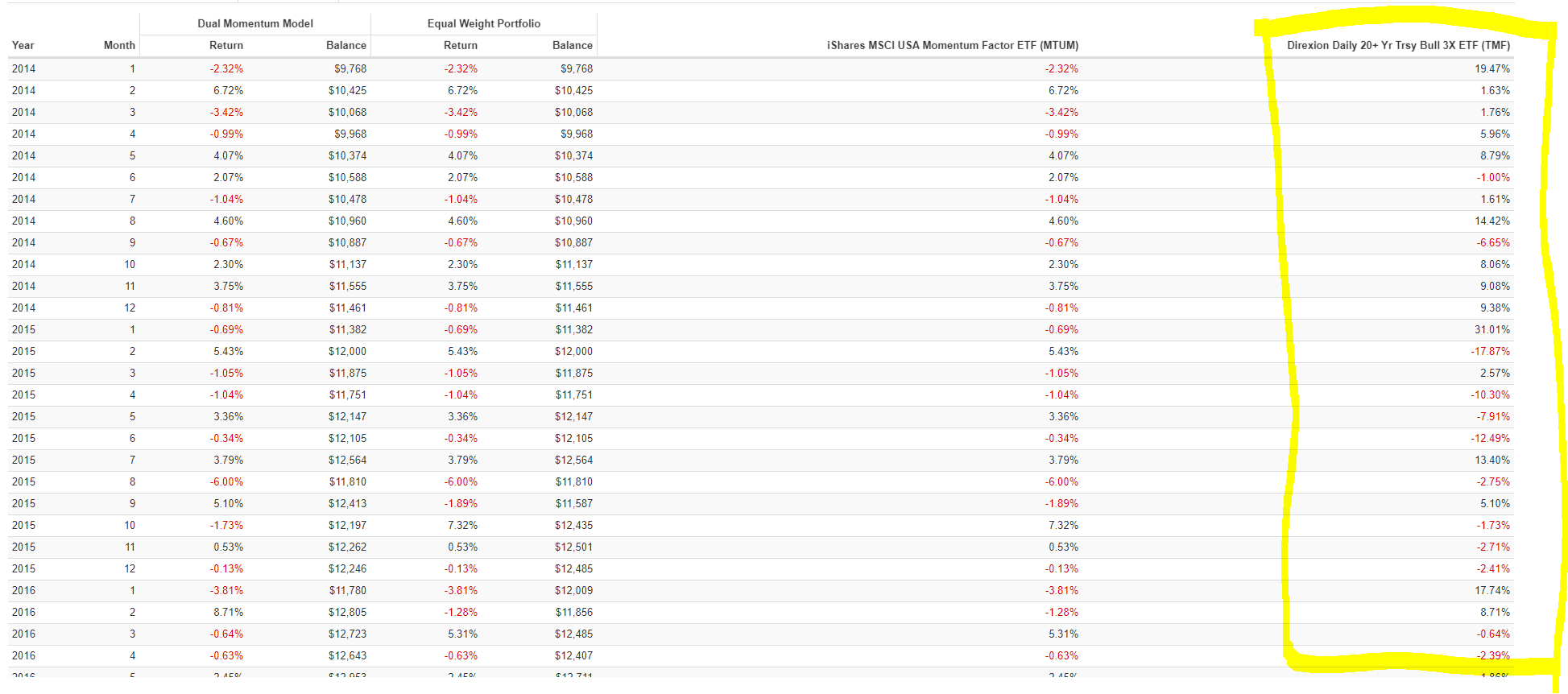

3.打開Portfolio visualizer–>Backtest Portfolio

1

4. 把前十名的個股放進去, 把Portfolio#1旁選單點開來, 選Equal weight, 持股比例就會自動平均分配, 然後按Analyze portfolios即可.

![iShares MSCI USA Momentum Factor ETF

Fund Holt

31-Mar-21

16-Apr-13

Inception

Shares ou 66300,coo.oo

PORTFOLIO VISUALIZER

Reinvest Dividends O

Shares Market Vi Notio

Q

Q

Q

Q

Q

Q

Q

Q

Q

Q

Analvzc Portfolios

Examples

Portfolio

10

10

10

10

10

10

10

10

10

10

Cancel

FAQ

Stock

Bond

Other

Isuer Tick Name

Display

Factor Regression O

Benchmark O

P ortfolio Names O

Portfolio Assets

Asset I

Asset 2

Asset 5

Asset 8

Asset 10 (,evdd More)

Total

None

Contact

Portfolio

Asset Clas Weight (Z Price

TSLA

MSFT

AAPL

AMZN

NVDA

PYPL

ADBE

TMO

GOOG

GOOGL

DHR

CRM

NFLX

NKE

QCOM

UPS

LOW

TESLA INC Equity

MICROSOFT (Equity

APPLE [NC Equity

AMAZON CO. Equity

NVIDIA CORI Equity

PAYPAL HOL Equity

ADOBE Equity

THERMO Equity

ALPHABET

ALPHABET Equity

DANAHER C(Eauity

SALESFORCE Equity

NETFLIX INC Equity

NIKE INC Cl.' Equity

QUALCOMM Equity

UNITED

LOWES COM] Equity

6.33

5.15

4.77

4.09

2.74

2.39

2.17

1.81

1.76

1.72

67.93

122.15

242.84

225.08

190.18

MSFT

GOOG

DHR](https://mlz8bk93vqkc.i.optimole.com/aMUVc68-a6QUYFjd/w:1024/h:585/q:eco/https://i2.wp.com/yyp-fire.com/wp-content/uploads/2021/05/image-16.png?resize=1024%2C585&ssl=1)

1

5.一秒鐘後結果出來, 選擇Monthly Returns.

1

6.把2021年4月的結果Copy到Excel工作表上

啊不是用2021/3/31的持股, 怎麼會是取4月的結果?

因為這個策略是每月1日依上月底公佈的持股前10名來決定下月的持股, 因此是取4月

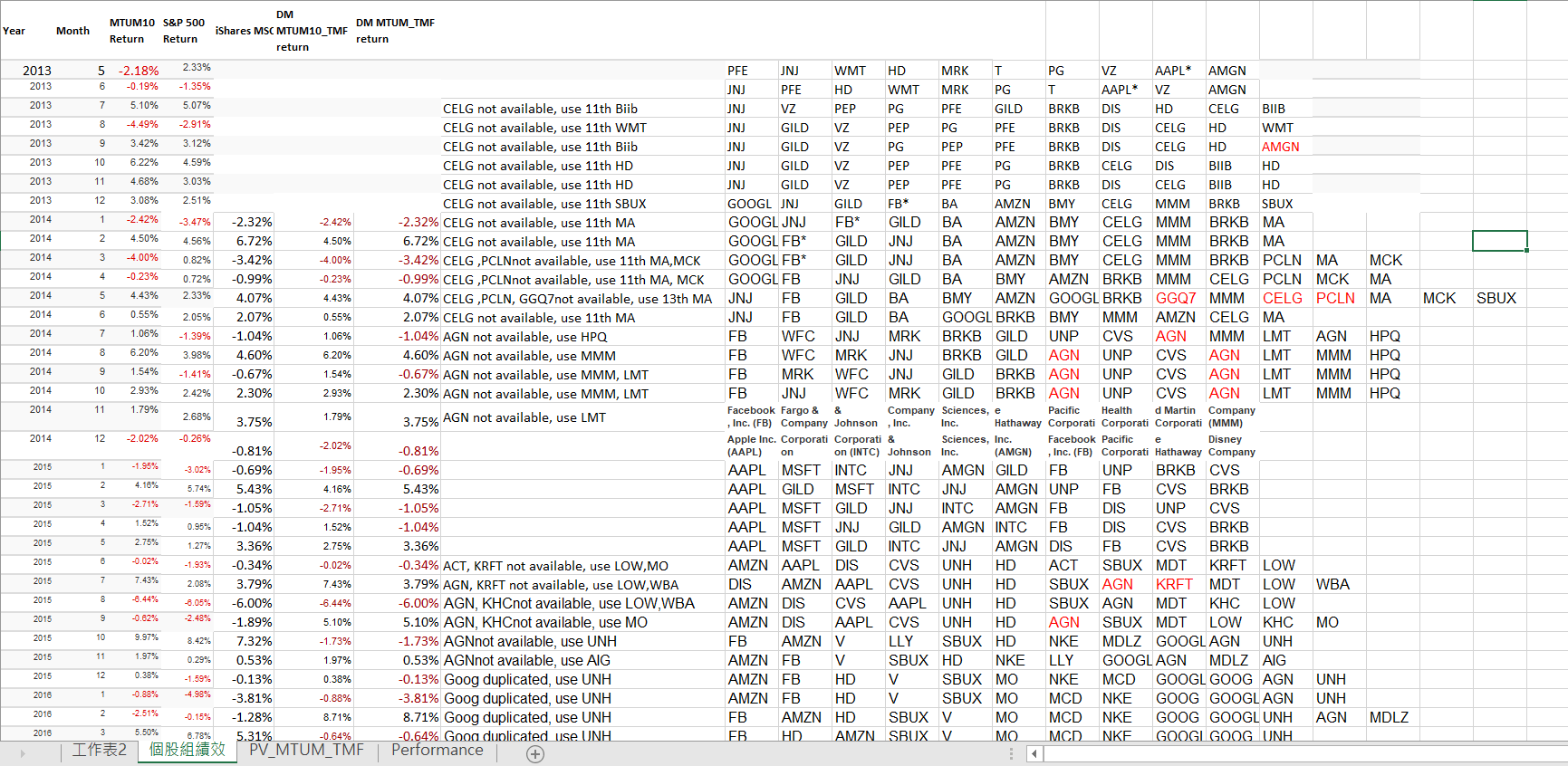

就這樣不斷重複, 把2013~2021的結果都填上去, 可以視自己的需求加上備註, 像阿批有註記某些持股已經不在了的註記和每個月的持股明細, 還有補上S&P 500、MTUM、MTUM-TMF冠軍策略組合的報酬, 來看看是不是真的有比較好.

1

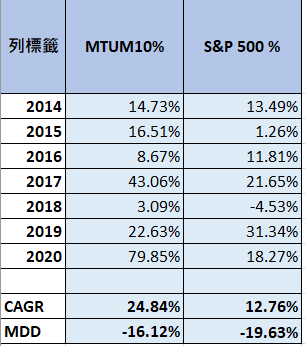

7.當把每個月前十檔的績效的報酬填入Excel工作表後, 就可以得到”每個月持有MTUM前十名持股”的長期報酬, 其實就已經不錯了, 是同期S&P 500的二倍.

說填這個麻煩嘛? 也還好, 就幾個小時的工罷了….比起在市場裡的金錢損失, 這沒什麼, 再說長期報酬率真能提升個幾個百分點, 那數字也是滿可觀.

1

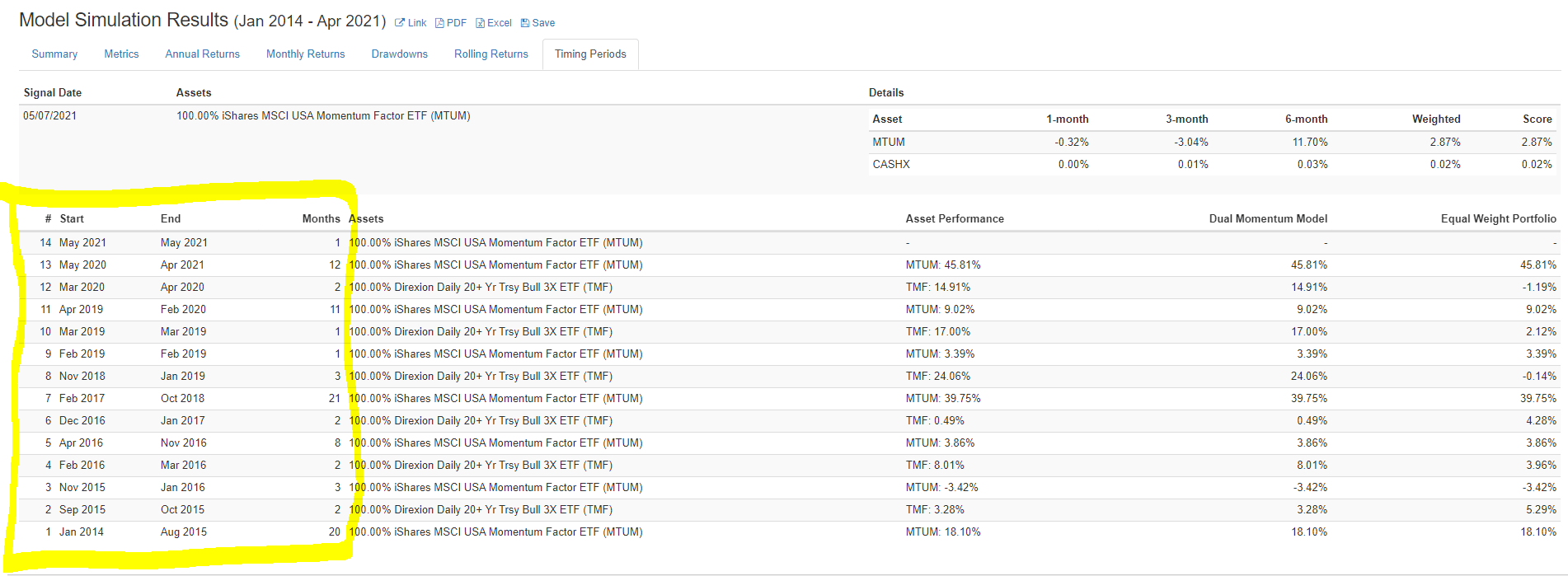

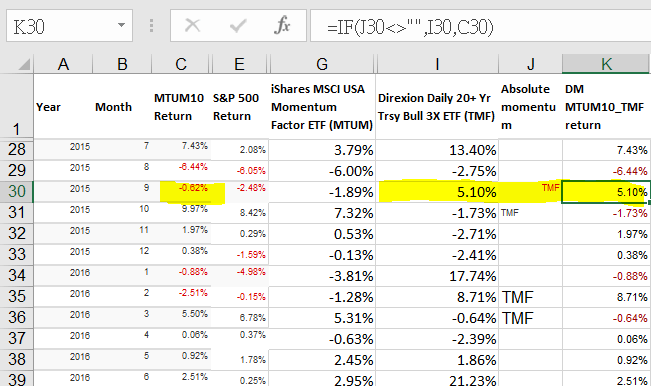

8. 而阿批要的是在大盤有系統性風險時會有MTUM當作單一絕對動能開關, 去將整個投資組合轉換成TMF, 因此我們要需要:

(1)MTUM-TMF的冠軍策略(ADM)組合的轉換Timing, 這可由Portfolio visulizer–>Timing models–>Dual Memntum去創建MTUM-TMF的組合, 然後取得Timing時間.

1

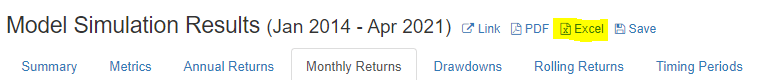

(2) 同期間TMF的報酬率, 這也可以從MTUM-TMF的回測資料中得到, 可以直接Copy或Download Excel檔.

1

9. 在原先填寫報酬的Excel工作表, 貼上TMF的報酬率, 並加上絕對動能的欄位, 就可以得到每月MTUM前10名的持股, 用MTUM當絕對動能去切換成TMF這個組合的報酬率.

1

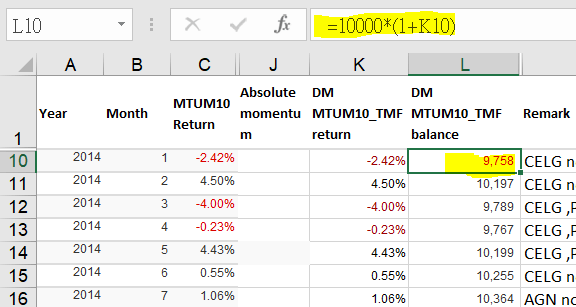

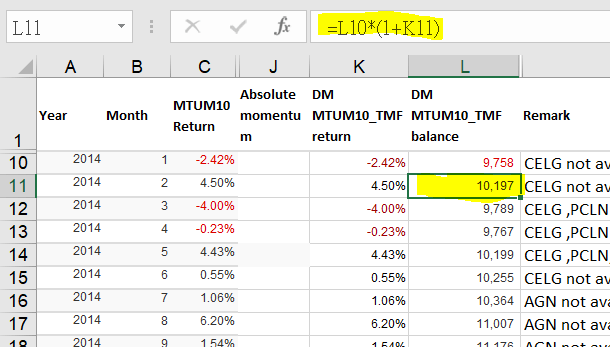

10. 接下來是要算每年的報酬率, 但不是用每個月的報酬率去直接加喔!

這裡應該是幾何平均報酬, 懶得帶公式的玩法就是先把報酬率換成每月的帳戶餘額.

1

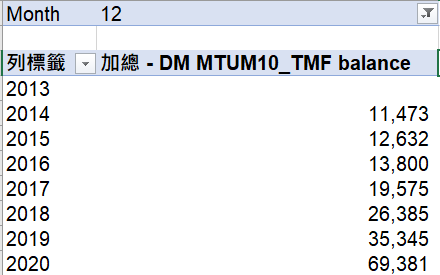

11. 再用樞紐分析表去抓每年12月底的帳戶餘額.

1

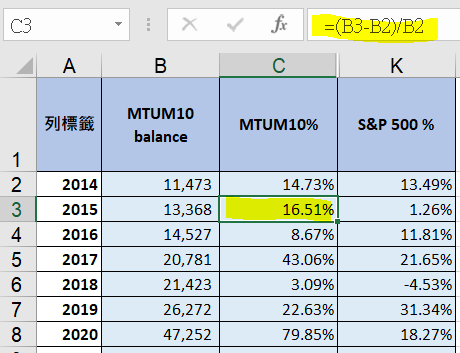

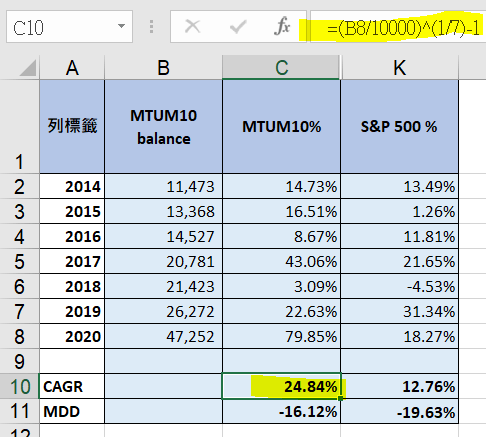

12. 比較和前期的差額比率就是年報酬率了.

1

13. 也可以依自己的需要加上需要的數字, 像阿批會看年複利成長率CAGR, 就公式帶一下囉….

最大回撤(MDD)是阿批很在意的, 通常我會從月報表上每個去細看找出來.

其它的比率像是Sharp ratio, Sortino ratio, 要去找每年的無風險利率, 比較麻煩, 有時就大概看一下標準差和CARG的比較, 心裡有底就好了.

1

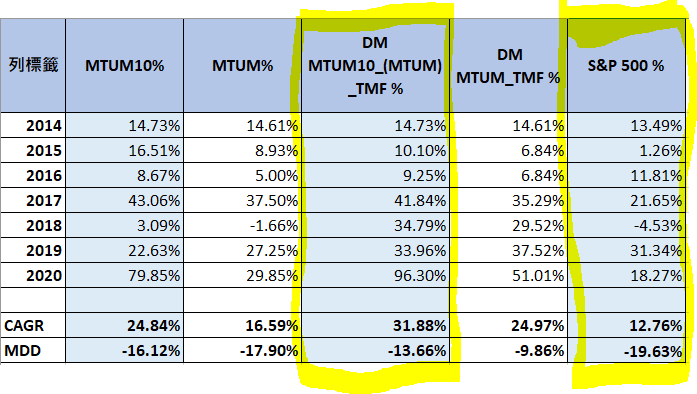

14. 最後的結果長這樣, 每月從MTUM挑前10名, 以MTUM為絕對動能, 切換TMF的組合, CAGR是31.88%, 同期S&P 500的報酬率是12.76%, 回撤也比較大.

與直接持有MTUM、直接持有每月前十名及使用MTUM-TMF冠軍策略(ADM)組合的比較, 也是較佳.

這樣算是親自驗證了<<賺贏大盤的動能投資法>>的投資方式了, 的確有效.

不過, 這樣的回測期間也還是算比較短的, 也不能忽略實務上每月再平衡是會因為買不滿整股或是損益金額太小無法再平衡的, 再加上進倉的滑價, 多少會有一點誤差啦,

再來, 持股10支, 要承受的個股風險也需要考量, 不過仍然是一個不錯的組合.

1

以上僅是個人的研究思考, 不是投資建議, 想要進場仍需自行做好功課.